-

Chances for Rebound in 2015 Looking Slimmer

By Alan Levitt June 30, 2015- Tweet

The rebalancing of world dairy markets is still beyond the horizon.

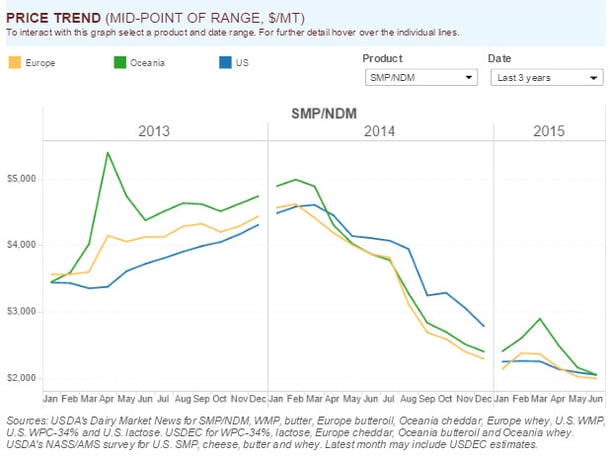

The rebalancing of world dairy markets is still beyond the horizon.At the halfway point of the year, the global dairy markets are in their weakest position since 2009. Furthermore, with the slow rebalancing of world supply and demand, most observers are coming to the realization that the chance of the markets still rebounding this year is getting slimmer and slimmer. Analysts are pushing out their timetable for any kind of sustained improvement in prices to somewhere in 2016.

Though commodity prices are down significantly from a year ago—milk powder off more than 40 percent; cheese, butter and whey down 20-30 percent—global milk supply continues to expand. In the first quarter, global milk supply from the five major suppliers ((EU-28, United States, New Zealand, Australia and Argentina) was about flat. But in April and May production was up about 2 percent, with gains from every corner.

Right now the world doesn’t need that kind of milk production growth. In the first five months of the year, China imports (on a milk-equivalent basis) were down 38 percent from last year. That’s the equivalent of pushing back about 507,000 tons (1.1 billion lbs.) of milk per month. Powder stocks are still plentiful, and China’s milk production is reportedly up about 4 percent this year.

Meanwhile, Russia remains mostly out of the market indefinitely. Last week, Russia extended its ban on EU, Australian and U.S. dairy products for another year.

Other importers, such as Mexico, Southeast Asia and Japan, have bought aggressively, but they can’t make up for what China and Russia are leaving on the table. And with these early purchases, buyers are stocked up pretty well for months to come. Most are content to take a wait-and-see attitude toward buying ahead further. Now, we ease into the summer trading lull; we don’t expect to see buyers show more interest until September. By then they’ll have a better sense of New Zealand’s prospects as well, and whether the El Niño is having any impact on production.

Other fundamental indicators:

- EU-28 milk deliveries in April are estimated at 13.2 million tons, up 2.0 percent from the extraordinary levels of last year. Among key countries in April: Ireland +11.3 percent; Netherlands +1.7 percent; Germany -1.4 percent; France -1.0 percent.

- New Zealand milk production was up 8.5 percent in April, while Australia posted a 2.9 percent gain. Pastures in New Zealand are in good condition for the start of next season.

- U.S. milk production continues to expand. May output was 8.3 million tons, up 1.4 percent from prior year.

- In the first five months of the year, China imported 223,137 tons of WMP, down 54 percent from the exceptional volumes bought last year, though about the same as the 2011-13 average for the same time period. SMP imports were down 31 percent and whey products were down 4 percent from a year ago.

- NZX futures continue to reflect bearish sentiments. WMP futures average $2350/ton to December.

- The GlobalDairyTrade (GDT) Price Index dropped for the seventh event in a row at the June 16 auction, falling 1.3 percent to an average winning price of $2,409/ton. The Index has dropped 29 percent since early March and now sits at its lowest level since August 2009. WMP was down 0.1 percent to an average winning price of $2,327/ton, SMP was off 0.2 percent to $1,978/ton and AMF was down 8.9 percent to $2,814/ton.

To hear me discuss the global dairy market outlook with Bill Baker on Dairyline, a DairyBusiness radio show, click the audio bar below.

The U.S. Dairy Export Council is primarily supported by Dairy Management Inc. through the dairy farmer checkoff that builds on collaborative industry partnerships with processors, trading companies and others to build global demand for U.S. dairy products.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (65)

- Africa (5)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (16)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (8)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Geographical Indications (GIs) (10)

- Global Marketing (87)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (247)

- Member Services (17)

- Mexico (40)

- Middle East (10)

- Middle East & North Africa (3)

- Middle East/North Africa (10)

- Milk (3)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (17)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (305)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (25)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- March 2014 (11)

- April 2015 (11)

- December 2015 (11)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- April 2024 (1)

- Mark O'Keefe (183)

- USDEC Staff (139)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Nick Gardner (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)